ESG Due-Diligence Consulting Ensuring Responsible Investment Decisions: Consultivo was engaged for a Pre-Acquisition ESG Due Diligence project for one of India’s leading asset management companies (AMC). We were entrusted to assess ESG risks, liabilities and opportunities, supporting the client in making informed investment decisions.

This ongoing project has successfully delivered 30+ ESG due diligence studies across 12+ industry sectors, including manufacturing, oil & gas, and education.

Navigating the way to

ESG & Sustainability Due Diligence

Supporting Investment – Merger – Acquisition

Why ESG Due Diligence Matters in M&A

The Importance of ESG Risk Management

Mergers and acquisitions (M&A) present both opportunities and risks. ESG Due Diligence helps uncover hidden risks associated with environmental, social, and governance factors. With potential liabilities on the line, a robust ESG review is essential for responsible decision-making.

Industry-Specific ESG Challenges

Each sector faces unique ESG challenges. For example, oil & gas companies may contend with environmental regulations, while service industries must focus on human capital and social responsibility. Our expertise spans across these sectors, ensuring a comprehensive ESG evaluation.

Project Scope and Methodology

Consultivo’s Pre-Investment ESG Due Diligence Toolkit

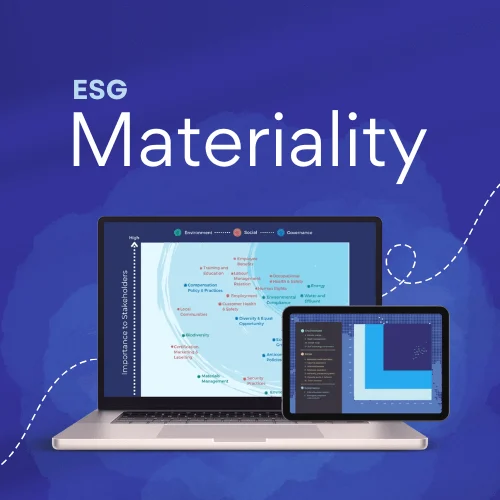

For this project, we developed a customised ESG Due Diligence toolkit, grounded in international and national standards, including IFC Performance Standards, BRSR requirements, and National Voluntary Guidelines for Responsible Financing.

This customised scoring protocol tailored specifically to the client’s unique needs in the pre-investment phase. This protocol was designed to evaluate the Target company’s ESG performance comprehensively, using a scoring system based on internationally recognized frameworks such as the IFC Performance Standards, BRSR requirements, and National Voluntary Guidelines for Responsible Financing.

Each ESG factor was meticulously assessed and assigned a score, reflecting both current compliance and areas of potential improvement. The scored protocol allowed the client to quickly understand the Target’s strengths, gaps, and critical risks, facilitating informed decision-making.

The flexibility of the protocol also enabled sector-specific adjustments, ensuring the review was relevant to the industry in which the Target operated.

By integrating this scoring system, the client gained a clear roadmap for corrective actions, including what the Target could achieve with enhanced ESG practices, empowering them to confidently proceed with their acquisition strategy.

Key Steps in ESG Due Diligence

- Target Company Discussions: Engaging with professionals responsible for ESG compliance.

- Document Review: Comprehensive assessment of ESG-related documentation (policies, audit reports).

- Desk-Based Research: Analysis of ESG risks using publicly available information.

- Site Condition Review & Management Interviews: On-site evaluations and discussions with senior management.

- Draft Report & Gap Analysis: Scoring the Target’s ESG performance, identifying gaps, and proposing corrective actions.

- Final Report Submission: Incorporating client feedback to deliver actionable insights and recommendations.

Read more on Consultivo ESG Consulting Solutions

Deliverables: What Consultivo Provides

Our deliverables are tailored to meet the specific needs of investors during M&A. For this project, we produced the following:

- ESG Review Report: Detailed analysis on the Target’s ESG score, identified gaps, and a corrective action plan.

- Recommendations for Improvement: Customised guidance on how the Target can improve its ESG standing.

- Red Flag Identification: Highlighting critical ESG issues requiring additional investigation.

Results and Impact

ESG Score and Risk Mitigation

Our analysis provided the AMC with a clear ESG score, identifying gaps and potential risks and opportunities for enhancement. This allowed the client to make data-driven investment decisions with confidence, ensuring they met international ESG standards.

Driving ESG Best Practices Across Sectors

By working across 12+ industry sectors, we have contributed to the integration of ESG best practices in multiple domains, strengthening the sustainability profile of our clients’ portfolios.

This holistic approach not only mitigated investment risks but also fostered a culture of sustainability within the Target, ensuring long-term value creation. The outcome has been instrumental in guiding the client toward responsible investment, reflecting the tangible impact of our due diligence services in driving sustainability and ethical business practices.

Consultivo’s Expertise in ESG Due Diligence

With over 30 ESG due diligence studies conducted, Consultivo stands as a leader in ESG risk assessment. Our team of experts brings deep knowledge of ESG, EHS, OHS, and Business & Human Rights, helping companies mitigate risks and unlock ESG-driven value in M&A scenarios.

National and International ESG Standards We Follow

Our ESG due diligence process is aligned with key standards, including:

- IFC Performance Standards

- The Environmental, Health, and Safety (EHS) Guidelines – The World Bank

- BRSR Requirements

- National Voluntary Guidelines on Responsible Financing

- Consultivo internal Guidelines on ESG Due Diligence

Ready to Explore ESG Due Diligence for Your Next Investment?

Being a leading ESG Due-Diligence Consulting Company, Consultivo can help you navigate the complexities of ESG Due Diligence, ensuring your investment decisions are informed and responsible.

Get in touch with our experts to learn how we can support your M&A needs.

Our Due Diligence Services

ESG Due Diligence

Environmental Due Diligence

E&S Due Diligence

EHS Due Diligence

OHS Due Diligence

HR Due Diligence

B&HR Due Diligence

About Consultivo Due Diligence Audit Services

Consultivo specialises in ESG and Sustainability-focused due diligence, designed to support pre-investment for Greenfield and Brownfield projects and M&A decisions.

With expertise in key areas such as ESG Due Diligence, ESDD, EHS Due Diligence, OHS Due Diligence, Environmental Due Diligence, HR Due Diligence, and Business & Human Rights Diligence.

As an ESG Due Diligence Consulting company or due diligence audit service provider, we help investors and companies identify risks and liabilities, assess compliance, and unlock opportunities for sustainable growth. We support informed, responsible, and strategic decision-making.

Empanelled sustainability consultant for International Finance Corporation (IFC), World Bank Group, KfW IPEX Bank, Germany and many more financial Institutions.

Consultivo is one of the leading ESG, Business Excellence and Risk Management Consultants.

An Advisory, Research, Audit & Training organisation helping global businesses in the areas of Sustainability, Business Excellence & Risk Management both at the strategic and operational levels.

Major service verticals include Safety, Sustainability, Environment & Energy, CSR, Management Systems, Organisational Development and Human Capital Development.

Consultivo works with 150+ National and International Sustainability related codes, standards and guidelines.

Consultivo Academy provides training and capacity-building services through both in-person sessions and e-learning platforms.

Slate of Swan is purpose driven ESG focused reporting, design, and impact communication agency.

Share this post

Category: Impact Stories

Tags: ESG | ESG Due Diligence | Diversified Industry Sectors | Financial Sector

Related insights

Impact Stories

Blogs

Blogs

Blogs

Impact Stories

Blogs

Blogs

Blogs

Blogs

Blogs

Blogs

Impact Stories

Impact Stories

Impact Stories

View more in Impact Stories | Blogs | Knowledge Bank | News and Events