ESG Due Diligence & ESDD Audit Services

For Merger & Acquisition (M&A), Pre-Investment Risk Assessment

ESG Due-Diligence and ESDD play a critical role in identifying environmental, social, and governance risks that can impact the sustainability and reputation of your business.

Our ESG Due Diligence and ESDD Services: Mitigating Risks and Ensuring Compliance for Strategic Investments.

Home / Social & Sustainability / M&A Due Diligence Services

Our ESG Due Diligence and ESDD Services: Mitigating Risks and Ensuring Compliance for Strategic Investments.

Our ESG due diligence & ESDD help organisations assess risks before mergers, acquisitions, or investments, ensuring compliance and long-term value.

Our ESG Due-Diligence services encompass an extensive review of your organisation’s environmental, social, and governance aspects to assess the overall sustainability and risk profile.

Our ESDD or E&S Due-Diligence focuses on evaluating both environmental and social factors critical to investment and operational success.

This solution is ideal for manufacturing, energy, and heavy industries where environmental impact and social responsibility are paramount.

01.

- ESG Due-Diligence

Our ESG Due-Diligence services encompass an extensive review of your organization’s environmental, social, and governance aspects to assess the overall sustainability and risk profile. This includes:

Environmental Due-Diligence

Assessing climate risks, carbon footprint, water usage, waste management, and overall environmental impact.

Social Due-Diligence

Evaluating human rights issues, labor conditions, community relations, and social license to operate.

Governance Due-Diligence

Analyzing corporate governance frameworks, business ethics, transparency, and anti-corruption measures.

02.

- ESDD or E&S Due-Diligence

Consultivo’s Environmental & Social Due Diligence (ESDD) services help organisations assess environmental and social risks in investments.

They ensure compliance with global standards and promoting sustainable, responsible decision-making.

Key components of our ESDD or E&S Due-Diligence include:

- Environmental risk assessments

- Social impact analysis and community engagement

- Assessment of compliance with World Bank EHS Guidelines, IFC Performance Standards, and local regulations

What is ESG Due-Diligence?

ESG Due-Diligence involves the assessment of a company’s environmental, social, and governance practices to identify risks and opportunities that could affect its financial performance and reputation.

This process includes evaluating:

- Environmental impact

- Human rights and labor practices

- Governance structures and ethical practices

- Regulatory compliance

Why is ESG Due-Diligence Important for M&A and Investments?

Businesses across industries, especially during Merger & Acquisition (M&A) processes, require a deep understanding of their ESG risks.

Our due diligence services help companies make informed investment decisions by:

- Identifying potential liabilities

- Ensuring compliance with local and global regulations

- Enhancing operational sustainability

- Minimizing reputational risks

Key Benefits of Our ESG Due-Diligence and ESDD Services

Risk Identification

Uncover hidden liabilities related to ESG factors that may affect the long-term profitability and reputation of your business.

Compliance & Standards Alignment

Ensure your operations meet global standards like IFC Performance Standards, UN Guiding Principles on Business and Human Rights, and industry best practices.

Informed Decision Making

Enable smarter investment decisions by understanding the full scope of ESG DD and ESDD risks.

Value Creation

Boost stakeholder trust and create long-term value through responsible and sustainable business practices.

Navigating the way to

ESG & Sustainability Due Diligence

Supporting Investment – Merger – Acquisition

GLOBAL Experience

Transforming businesses for a sustainable tomorrow

750+ clients

in over 4 continents and 19 countries

2K+ projects

across the value chain

15+ years

at the forefront of ESG and Sustainability Advisory Space

Ensure every deal is built on a foundation of thorough, strategic due diligence.

Our expertise helps protect investments, enhance transaction value, and promote seamless post-acquisition integration.

Our M&A Due Diligence Services

ESG Due Diligence

Environmental Due Diligence

E&S Due Diligence

EHS Due Diligence

OHS Due Diligence

HR Due Diligence

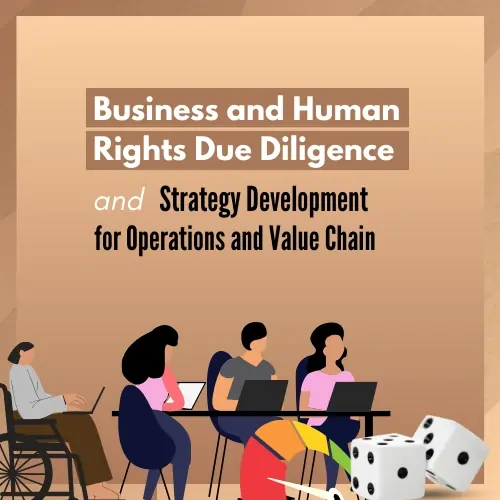

B&HR Due Diligence

Related services for Informed Decision-Making

Identify ESG risks and opportunities and develop a tailored action plan with our ESG Gap Assessment.

For a gap assessment in overall environmental management, governance, compliance & performances.

Identifying gaps related to environmental regulations and industry-specific compliance.

Assess occupational health and safety risks.

Identify the EHS (Environment, Health & Safety) risks in your unit/operations that may lead to a loss.

Optimise your HR practices and enhance employee satisfaction with our expert HR audits.

Includes workforce-related risks, compliance with labour laws and human rights issues.

Assess the potential environmental & social impacts of a project to identify mitigation measures.

Why Choose Consultivo for ESG Due-Diligence and ESDD?

As one of the leading ESG Consulting and Advisory companies in India, Consultivo offers:

01

Expertise across multiple industries

From financial services to energy, mining, and manufacturing, our team provides tailored due diligence solutions that align with your business objectives.

02

Global Standards Compliance

We ensure compliance with global ESG standards and frameworks such as the Global Reporting Initiative (GRI), SASB, ISO 26000, and UN Principles for Responsible Investment.

03

Actionable Insights

Our team delivers comprehensive reports that outline risks, potential liabilities, and clear mitigation plans to safeguard your business's future.

Unsure where to begin with Non-financial due diligence of your investment decisions?

Our detailed Due diligence (DD) reports help you identify the most important environmental, social, and governance issues for your business and stakeholders.

Focus your efforts, maximise benefits.

Let’s develop a winning due diligence strategy together.

Get in Touch with Consultivo

For more information about our ESDD and ESG Due-Diligence services, contact us today.

Let us help you navigate complex ESG risks and unlock opportunities for sustainable growth.

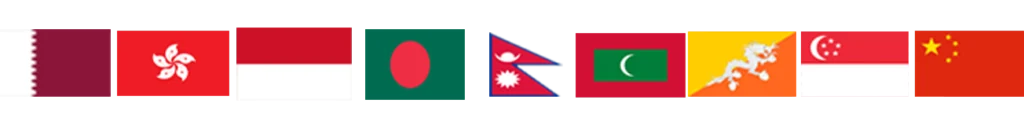

How Consultivo Conducts ESDD and ESG Due-Diligence

Our Due-Diligence Process

Data Collection & Assessment

Gathering relevant data on your operations, supply chain, and value chain for detailed analysis.

Stakeholder Engagement

Engaging with internal and external stakeholders to understand potential risks and opportunities.

On-Site Assessment

Conducting physical site visits to evaluate real-time conditions and identify non-compliance issues.

Gap Analysis & Risk Mapping

Identifying gaps in current practices and mapping potential risks across environmental, social, and governance aspects.

Reporting & Recommendations

Providing a detailed report with actionable recommendations for mitigating identified risks.

About Consultivo Due Diligence Audit Services

Consultivo specialises in ESG and Sustainability-focused due diligence, designed to support pre-investment for Greenfield and Brownfield projects and M&A decisions.

With expertise in key areas such as ESG Due Diligence, ESDD, EHS Due Diligence, OHS Due Diligence, Environmental Due Diligence, HR Due Diligence, and Business & Human Rights Diligence.

As an ESG Due Diligence Consulting company or due diligence audit service provider, we help investors and companies identify risks and liabilities, assess compliance, and unlock opportunities for sustainable growth. We support informed, responsible, and strategic decision-making.

Empanelled sustainability consultant for International Finance Corporation (IFC), World Bank Group, KfW IPEX Bank, Germany and many more financial Institutions.

Consultivo is one of the leading ESG, Business Excellence and Risk Management Consultants.

An Advisory, Research, Audit & Training organisation helping global businesses in the areas of Sustainability, Business Excellence & Risk Management both at the strategic and operational levels.

Major service verticals include Safety, Sustainability, Environment & Energy, CSR, Management Systems, Organisational Development and Human Capital Development.

Consultivo works with 150+ National and International Sustainability related codes, standards and guidelines.

Consultivo Academy provides training and capacity-building services through both in-person sessions and e-learning platforms.

Slate of Swan is purpose driven ESG focused reporting, design, and impact communication agency.

Browse our Impact Stories

Featured Insights

Speak to us or drop us a WhatsApp message

Let's discuss

Curiosity zone

Questions? We have answers.

What Is Due Diligence?

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

What are Consultivo's core competencies in conducting investment-grade due diligence?

Consultivo’s core competencies in investment-grade due diligence span ESG, Environmental, OHS, EHS, E&S, HR, and Business & Human Rights (B&HR) due diligence.

Trusted by organisations like IFC (World Bank Group) and multiple global investors and financial consultants, we also offer environmental, compliance, and HR audits.

Our expertise ensures thorough risk evaluation, regulatory compliance in geographic areas or jurisdictions, and investor confidence, helping drive successful transactions.

Who are the interested parties for a due diligence process?

The interested parties for the due diligence services, particularly for investment and M&A decisions, would include:

- Private Equity Firms & Venture Capitalists: Investors focused on acquiring companies or stakes in businesses who need ESG insights to mitigate risks and align with responsible investment standards.

- Investment Banks & Financial Advisors: Advisors involved in M&A transactions who require comprehensive ESG due diligence to offer strategic advice and help structure deals with minimised risks.

- Institutional Investors & Asset Managers: Pension funds, mutual funds, and other institutional investors looking for long-term value through responsible investing practices that factor in ESG risks.

- Corporate M&A Teams: Internal teams in companies planning acquisitions, joint ventures, or mergers, especially those committed to ESG-driven growth and sustainability objectives.

- Legal & Risk Advisors: Law firms and risk management consultants advising clients on the legal and compliance risks associated with ESG factors during M&A or investment processes.

- Sovereign Wealth Funds: State-owned investment funds that integrate ESG factors into their decision-making, ensuring their investments align with government policies on sustainability.

- Family Offices & High-Net-Worth Investors: Wealth management entities focused on responsible investments, ensuring ESG alignment for future growth and impact.

- Multinational Corporations (MNCs): Companies expanding through mergers or acquisitions that need to ensure ESG compliance across diverse markets and geographies.

- ESG Ratings Agencies & Analysts: Organisations evaluating the ESG performance of potential investment targets and needing robust data from thorough due diligence processes.

This audience values robust, data-driven ESG analysis to ensure long-term value creation, risk mitigation, and compliance with sustainability frameworks in their investment decisions.