ESG Due Diligence Guide and ESG Due-Diligence Checklist | In today’s business landscape, sustainability and responsible investing have become critical factors for both investors and businesses. Environmental, Social, and Governance (ESG) factors play a pivotal role in decision-making processes.

As a result, ESG due diligence or ESG DD has emerged as an essential practice for organisations looking to evaluate potential investments or partnerships.

This step-by-step guide will walk you through the process of conducting comprehensive ESG due diligence. From understanding the key principles and frameworks to conducting thorough assessments, this article lays out everything you need to know to make informed, responsible decisions.

Throughout the guide, you will learn how to identify and evaluate ESG risks and opportunities, assess a company’s ESG performance, and incorporate these findings into your decision-making process.

By following this guide, you will be equipped with the tools and knowledge to integrate ESG considerations into your investment strategy or business practices, align with your values, and ultimately contribute to a more sustainable and ethical future.

Join us as we embark on this journey of ESG due diligence or ESG DD, empowering you to make responsible investments and drive positive change in the world.

Navigating the way to ESG & Sustainability Due Diligence: Your Risk Mitigation Tool

What is ESG due diligence

ESG due diligence is the process of systematically evaluating the environmental, social, and governance factors of a company or investment opportunity.

It involves identifying and assessing the risks and opportunities associated with these factors to make informed decisions.

ESG due diligence goes beyond traditional financial analysis and takes into account the long-term sustainability and ethical implications of an investment or business partnership.

Navigating the way to

ESG & Sustainability Due Diligence

Supporting Investment – Merger – Acquisition

Importance of ESG due-diligence

ESG due diligence is important for several reasons. First and foremost, it helps investors and organisations mitigate potential risks and identify opportunities. By understanding a company’s ESG performance, investors can gauge its long-term financial viability and resilience.

Additionally, ESG DD allows organisations to align their investments and business practices with their values and sustainability goals. It helps foster transparency and accountability, which are crucial for building trust with stakeholders.

Moreover, ESG due diligence is increasingly demanded by investors and stakeholders. Many institutional investors and asset managers now require companies to disclose their ESG performance, making it a crucial factor in attracting capital.

Furthermore, regulatory bodies are placing greater emphasis on ESG reporting and compliance, making it essential for companies to prioritise ESG due diligence to avoid legal and reputational risks.

Our M&A Due Diligence Services

ESG Due Diligence

Environmental Due Diligence

E&S Due Diligence

EHS Due Diligence

OHS Due Diligence

HR Due Diligence

B&HR Due Diligence

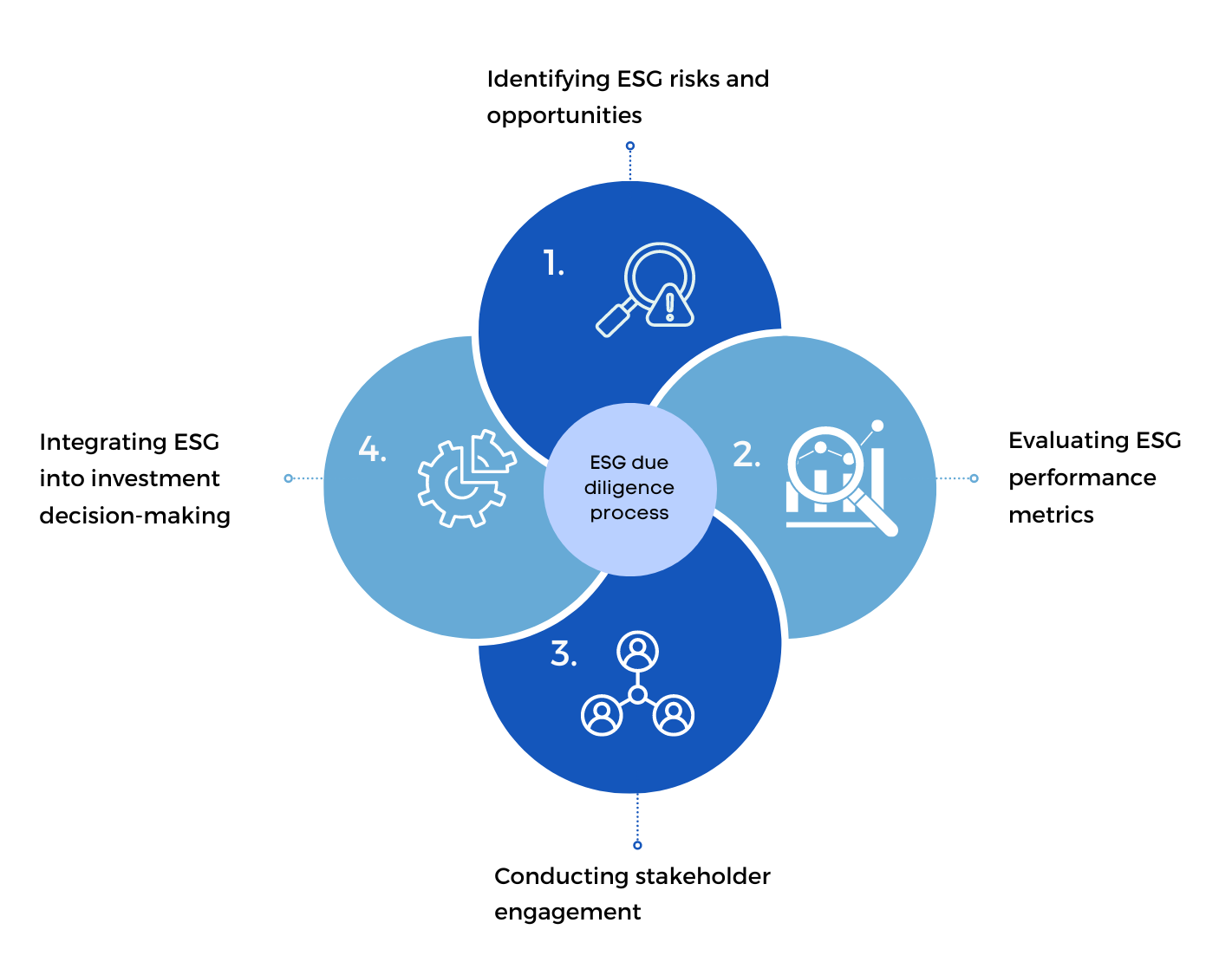

ESG due diligence process

The ESG due-diligence process typically involves several key steps. While the specific approach may vary depending on the organisation and the nature of the investment or partnership, the following steps provide a general framework for conducting comprehensive ESG due-diligence.

1. Identifying ESG risks and opportunities

The first step in ESG DD is to identify the potential ESG risks and opportunities associated with the investment or partnership. This involves conducting a thorough assessment of the industry, market trends, and regulatory landscape to understand the specific ESG factors that are relevant. The existing ESG Materiality Assessment (if available) plays an important role as input for a due diligence process.

For instance, in the energy sector, climate change and carbon emissions and carbon footprint may be significant risks, while in the apparel industry, managing labor rights and ethical supply chain management may be key considerations.

To identify these risks and opportunities, organisations can leverage various sources of information, such as industry reports, academic research, and ESG databases.

It is important to engage with subject matter experts and stakeholders to gain insights into the specific ESG challenges and opportunities within the sector.

2. Evaluating ESG performance metrics

Once the risks and opportunities have been identified, the next step is to evaluate the ESG performance metrics of the company or investment opportunity. This involves assessing the company’s policies, practices, and performance in relation to key ESG factors. Common ESG performance metrics include carbon emissions, water usage, labor practices, diversity and inclusion, board composition, and governance structure.

To evaluate these metrics, organisations can use a combination of quantitative and qualitative analysis. This may involve reviewing public disclosures, annual reports, sustainability reports, and other relevant documents. It is also important to consider third-party ESG ratings, rankings and ESG Assurance to gain an external perspective on the company’s performance.

3. Conducting stakeholder engagement

Stakeholder engagement is a critical component of ESG due diligence. It involves actively seeking input and feedback from a wide range of stakeholders, including employees, customers, suppliers, local communities, and non-governmental organisations (NGOs).

Engaging with stakeholders helps organisations gain a comprehensive understanding of the social and environmental impact of the company or investment opportunity.

Stakeholder engagement can take various forms, such as surveys, interviews, focus groups, and public consultations. It is important to ensure that the engagement process is inclusive and transparent, allowing different perspectives to be heard. This not only helps identify potential ESG risks and opportunities but also builds trust and strengthens relationships with stakeholders.

Explore to our ESG & Sustainability Due Diligence

4. Integrating ESG into investment decision-making

The findings from the previous steps should be integrated into the investment decision-making process. This involves weighing the ESG risks and opportunities alongside traditional financial considerations. Organisations can develop a scoring system or a set of criteria to assess the overall ESG performance of the company or investment opportunity.

Integrating ESG into decision-making requires collaboration between different departments within the organisation, such as finance, sustainability, and legal. It is important to establish clear guidelines and processes to ensure consistency and accountability. Additionally, organisations should consider setting ESG targets and goals for improving sustainability performance over time.

Tools and resources for conducting ESG due diligence

1. ESG databases and platforms

There are several ESG databases and platforms that provide access to ESG performance data, ratings, and rankings. These platforms aggregate information from various sources and offer comprehensive insights into a company’s ESG performance. Some popular ESG databases include MSCI ESG Research, Sustainalytics, and Bloomberg ESG Data.

2. ESG frameworks and guidelines

ESG frameworks and guidelines provide organisations with a structured approach to assessing and reporting on their ESG performance. These frameworks offer a set of principles and indicators that can be used to evaluate ESG risks and opportunities.

Some widely recognized ESG frameworks include the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD).

3. ESG consultants and experts

Engaging ESG consultants and experts can provide valuable insights and guidance throughout the ESG due diligence process. These professionals specialise in ESG analysis and can help organisations navigate the complexities of ESG evaluation. ESG Advisors can provide customised solutions and recommendations based on the specific needs and objectives of the organisation.

4. Industry associations and networks

Industry associations and networks often offer resources and guidance on ESG DD specific to a particular sector. These associations bring together companies, investors, and other stakeholders to share best practices and collaborate on sustainability initiatives. By joining these networks, organisations can access industry-specific knowledge and connect with like-minded peers.

Best practices for successful ESG due diligence

While the ESG due diligence process may vary depending on the organisation and the investment or partnership, there are some best practices that can help ensure a successful ESG evaluation.

Here are a few key considerations:

1. Set clear objectives and goals

Before embarking on ESG due-diligence, it is important to define clear objectives and goals. This involves identifying the specific ESG factors that are most relevant to the organisation and determining the desired outcomes of the evaluation.

Setting clear objectives helps focus the ESG due diligence process and ensures that the findings are actionable.

2. Foster cross-functional collaboration

ESG due diligence requires collaboration between different departments within the organisation. It is important to foster cross-functional collaboration and ensure that all relevant stakeholders are involved throughout the process. This includes representatives from finance, sustainability, legal, and other key departments.

Collaboration helps ensure that all perspectives are considered and that the evaluation is comprehensive.

3. Regularly review and update ESG performance

ESG due diligence should not be a one-time exercise. It is important to regularly review and update the organisation’s ESG performance. This involves monitoring key ESG metrics, tracking progress against targets and goals, and adapting strategies as needed.

Regular reviews help identify emerging risks and opportunities and ensure that the organisation stays aligned with its sustainability objectives.

4. Communicate transparently and engage stakeholders

Transparency and stakeholder engagement are crucial for successful ESG due diligence. Organisations should communicate their ESG performance openly and transparently, both internally and externally.

This includes disclosing relevant ESG information through ESG and Sustainability Reports, Annual Reports, and other channels. Additionally, organisations should actively engage with stakeholders and seek their input and feedback throughout the ESG DD process.

The Road Ahead Begins Now

ESG due diligence is a critical practice for organisations looking to make responsible investments and drive positive change in the world. By systematically evaluating the environmental, social, and governance factors of a company or investment opportunity, organisations can mitigate risks, identify opportunities, and align their investments with their values and sustainability goals.

This step-by-step guide has provided an overview of the ESG due-diligence process, from identifying ESG risks and opportunities to evaluating ESG performance metrics and conducting stakeholder engagement.

It has also highlighted the importance of integrating ESG considerations into investment decision-making and provided tools and resources to facilitate the ESG due diligence process.

By following this guide and adopting best practices, organisations can effectively integrate ESG considerations into their investment strategies or business practices, contributing to a more sustainable and ethical future.

ESG due diligence is not only a responsible business practice but also a key driver of long-term financial performance and resilience. Embrace the journey of ESG due-diligence and be a catalyst for positive change.

ESG due diligence is no longer an add-on; it’s an essential step towards responsible and sustainable business practices.

Here are some Practical Tips for Success:

Seek professional guidance:

Consider involving ESG due diligence specialists to ensure a thorough analysis. Check:

- Industry expertise

- Due diligence expertise

- Expertise on ESG codes, standards, framework and compliance requirements

Define Clear Objectives:

Clearly outline the purpose and scope of the ESG due diligence process to ensure alignment with organisational goals and stakeholder expectations.

Maintain a focus on materiality:

Don’t get bogged down by every ESG factor; prioritise those most relevant to the company. Prioritise ESG issues based on their materiality to the business and their potential impact on financial performance, reputation, and stakeholder relationships.

Use of Robust Tools and Frameworks:

Utilise established ESG frameworks and tools, such as the Sustainability Accounting Standards Board (SASB) standards or the Task Force on Climate-related Financial Disclosures (TCFD) framework, to guide the due diligence process and ensure comprehensive coverage of relevant issues.

Comprehensive Risk Assessment:

Conduct a thorough assessment of environmental, social, and governance risks associated with the business operations, supply chain, and industry sector.

Legal and Regulatory Compliance:

Ensure compliance with applicable laws, regulations, and industry standards related to ESG issues, such as environmental regulations, labor standards, and corporate governance requirements.

Engage Stakeholders:

Involve key stakeholders, including investors, customers, employees, and communities, to gather diverse perspectives and insights on ESG risks and opportunities.

Embrace transparency:

Encourage open communication with the target company throughout the process.

Mitigation Strategies and Action Plans:

Develop mitigation strategies and action plans to address identified ESG risks and capitalize on opportunities, including setting targets, implementing best practices, and monitoring progress over time.

Continuous Monitoring and Reporting:

Establish mechanisms for ongoing monitoring, reporting, and disclosure of ESG performance to stakeholders, and regularly review and update ESG due diligence processes to adapt to changing circumstances and emerging trends.

ESG Due Diligence Checklist

This checklist is designed to support a comprehensive ESG due diligence process for investment purposes, incorporating global requirements, good practices, and standard considerations. Utilise this tool alongside your defined investment strategy and adapt it to the specific company and industry being evaluated.

Environmental Due Diligence

Compliance with Environmental Regulations

- Identify all relevant environmental laws, regulations, and permits at local, national, and international levels pertaining to the company’s operations.

- Assess the company’s compliance history with environmental regulations, including any violations or fines incurred.

- Evaluate the potential financial and reputational risks associated with non-compliance.

Environmental Impact Assessment

- Assess the company’s environmental footprint across key metrics:

- Air emissions (Greenhouse Gases, SOx, NOx, etc.)

- Waste generation and management practices (hazardous and non-hazardous)

- Water usage and conservation efforts

- Land use and potential impact on biodiversity

- Evaluate potential environmental liabilities, such as historical contamination or remediation needs.

Natural Resource Management

- Assess the company’s management of natural resources:

- Energy consumption and efficiency measures

- Water usage and conservation practices

- Raw material sourcing and sustainability practices

- Evaluate the company’s commitment to resource efficiency and potential opportunities for circular economy initiatives.

Climate Change Risks and Opportunities

- Assess the company’s exposure to physical climate risks (e.g., extreme weather events, rising sea levels) and transition risks (e.g., carbon pricing, regulatory changes).

- Evaluate the company’s adaptation and mitigation strategies for climate change.

- Identify potential opportunities for the company to benefit from the low-carbon transition (e.g., renewable energy, energy efficiency solutions)

Social Due Diligence

Labor Practices and Human Rights

- Evaluate the company’s labor practices:

- Working conditions (safety, health, fair wages, working hours)

- Compliance with labor laws and international labor standards

- Presence of unions and freedom of association

- Anti-discrimination and equal opportunity policies

- Assess the company’s human rights due diligence practices within its operations and supply chain.

Supply Chain Management

- Evaluate the company’s supply chain management practices:

- Supplier selection and onboarding processes

- Monitoring of labor practices and environmental standards throughout the supply chain

- Mechanisms for addressing social and ethical issues within the supply chain

Community Relations and Stakeholder Engagement

- Evaluate the company’s engagement with local communities, indigenous peoples, and other stakeholders:

- Consultation processes for decision-making that may impact communities

- Grievance mechanisms for addressing community concerns

- Corporate social responsibility (CSR) initiatives and contributions to community development

Diversity, Equity, and Inclusion (DEI)

- Review the company’s policies and practices related to DEI:

- Workforce diversity (gender, race, ethnicity, LGBTQ+)

- Equal opportunity in recruitment, promotion, and development

- Pay equity and addressing any gender pay gaps

- Fostering an inclusive workplace culture

Governance Due Diligence

Corporate Governance Structure

- Assess the company’s corporate governance structure:

- Board composition (independence, skills, diversity)

- Board oversight of ESG issues

- Effectiveness of board committees (e.g., sustainability committee)

- Adherence to relevant corporate governance codes and best practices

Ethical Business Practices

- Evaluate the company’s commitment to ethical business practices:

- Anti-corruption measures and bribery prevention policies

- Whistleblower protection mechanisms

- Code of conduct and adherence to ethical standards

- Transparency in business dealings

- Supply Chain Management:

- Assess the company’s supply chain practices, including supplier relationships, labor conditions, environmental impacts, and efforts to address social and ethical issues throughout the supply chain.

- Risk Management and Disclosure

- Review the company’s ESG risk management processes:

- Identification, assessment, and mitigation of ESG risks

- Integration of ESG considerations into enterprise risk management framework

- Disclosure practices related to material ESG issues in financial reporting and sustainability reports

Standard Requirements:

Comprehensive Documentation

- ‘0Maintain comprehensive documentation of ESG due diligence processes, findings, and actions taken to address identified risks and opportunities.

Independent Verification and Assurance

- Seek independent verification and assurance of ESG data and disclosures to enhance credibility, reliability, and transparency.

Compliance with Reporting Standards

- Ensure compliance with relevant ESG reporting standards, frameworks, and guidelines, such as the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Task Force on Climate-related Financial Disclosures (TCFD).

Good Practices

Stakeholder Engagement and Transparency

- Assess how ESG considerations are integrated into the company’s business strategy, decision-making processes, and performance metrics.

- Evaluate how ESG factors are linked to long-term value creation and risk mitigation.

Integration with Business Strategy

- Assess how ESG considerations are integrated into the company’s business strategy, decision-making processes, and performance metrics.

- Evaluate how ESG factors are linked to long-term value creation and risk mitigation.

Let's discuss

Q 1. What is the most critical or important success factor of ESG Due Diligence?

Identifying the absolute “most important” factor can be subjective, but in our consideration, the key success factors for effective ESG due diligence is:

Materiality Assessment and Focus: Prioritizing the most relevant ESG factors for the specific company and industry being evaluated. A generic one-size-fits-all approach won’t capture the nuances of risk and opportunity. For instance, water usage might be a critical factor for a beverage company, but less so for a software firm.

Q 2: What does ESG due diligence involve?

Answer: ESG due diligence helps you identify potential risks like environmental liabilities or labor issues that could impact a company’s bottom line. It also uncovers opportunities related to sustainability and social responsibility, which are increasingly important for long-term success.

Q 3: Why is ESG due diligence important?

HRIA involves stakeholder engagement, impact identification and assessment, and risk mitigation and management. These components ensure a comprehensive evaluation of a business’s influence on human rights and the environment.

Share this post

About the author

Director – Sustainable solutions at Consultivo

Madhabi Guha specialises in the domains of ESG, Social Compliance, Business and Human Rights, Development Projects and focuses on supporting go-to-market teams along with customer and partner relationships. Madhabi has been working in the sustainability & business excellence advisory business for over 14 years.

Madhabi has been developing individuals, teams, and organisations in the areas of leadership, excellence and Human Factors in the field of sustainability, people and community.

Related insights