Simplify Your BRSR Compliance & Lead with ESG Excellence

India's leading ESG consultants help you navigate SEBI's BRSR framework with zero errors and investor-grade reports

Create value through transparent and impactful BRSR reporting

Partner with Confidence

Ensure every deal is built on a foundation of thorough, strategic due diligence. Our expertise helps protect investments, enhance transaction value, and promote seamless post-acquisition integration.

Services

1.

BRSR Assurance

Reasonable and Limited Assurance

2.

BRSR Value Chain

Managed service for Audit, Support and Reporting

3.

BRSR Training

Are you struggling with data collection across multiple sites?

Consultivo handles the complexity while you focus on business.

Our Global Footprint & Experience

- Service provided across 4 continents and 20 countries

- Strong regional expertise in India, the Middle East, and SAARC countries

BRSR Advisory - Audit, Consultancy, Reporting

Achieve seamless compliance and drive sustainability excellence with Consultivo’s end-to-end BRSR solutions through the technology platform ESGSlate.

Empowering your business to bridge ESG gaps, enhance performance, and lead responsibly in the evolving landscape of sustainability.

Worried About Your BRSR Report? Think With Us!

New Training

07 March 2026 (Saturday)

Experience our End-to-End BRSR Solutions

BRSR Reporting

Awaken and transform BRSR into a powerful tool for impact.

Get to know all the elements in your report and how we can help you

BRSR – All about SEBI Guided ESG Reporting

Consultivo – The unique experience

Consultivo as an organization has acquired a wealth of knowledge and expertise in numerous multi-location environmental, health & safety, and social projects and ESG efforts; while partnering with its customers in the capacity of an advisor, consultant, assessor, or trainer.

We identify, quantify and prioritize current, contingent, and future ESG and sustainability exposures. Our experience allows us to anticipate issues, enabling them to be proactively addressed before transaction timelines are impacted.

Featured solutions

Unlock sustainable success with Consultivo’s expertise across the value chain.

Frequently Asked Questions (FAQs)

Questions? We have answers.

Is BRSR applicable for all companies?

Applicability of Business Responsibility and Sustainability Reporting (BRSR)

Reporting under the new requirements of Business Responsibility and Sustainability Reporting has been made mandatory for the top 1,000 listed companies by market capitalization from FY 2022-23 onwards.

Other companies can voluntarily submit BRSR effective 2021-22.

For the purpose of determining applicability of the requirement, market capitalization would be calculated as on 31 March of every financial year.

Are unlisted companies covered under BRSR requirements?

Business Responsibility and Sustainability Reporting and unlisted companies

As per the MCA committee recommendation, the reporting requirement may be extended by MCA to unlisted companies based on specified thresholds of turnover or paid-up capital.

Further, the committee recommends that on a voluntary basis, smaller unlisted companies below this threshold limit may adopt a lite version of the format.

Two formats for disclosures are available; a comprehensive format for listed companies; and a lite version for unlisted companies, in case it is extended to them.

What are the steps to be followed by aspiring companies?

Steps for Business Responsibility and Sustainability Reporting

Companies who are mandated to comply with SEBI BRSR reporting requirements need to invest in necessary mechanisms which could help in the following aspects:

- Selection of the relevant and applicable ESG requirements material to the organization

- Enable capturing the required data for reporting on the selected ESG issues

- Selection of a suitable framework and related metrics that can be adopted by companies to facilitate transparent and accurate reporting

- Level of assurance to be provided on such reporting

International movements on ESG Reporting

ESG Reporting and Global Movements

Governments of several countries have introduced disclosures on sustainability reporting. Countries like Denmark, South Africa, China, Malaysia and Philippines require certain companies to make disclosures in relation to their non-financial performance across ESG aspects.

EU Non-Financial Reporting Directive is one of the most significant EU-wide legislative initiatives to promote sustainability reporting. Climate change related reporting is prevalent in Australia, Mexico, USA, and in France. The Modern Slavery Act, first enacted by the UK in 2015 and more recently by Australia, asks each company to report on modern slavery not just in its operations but also in its global supply chains, thereby including many SMEs in emerging markets.

International investors with global investment portfolios are increasingly calling for high quality, transparent, reliable and comparable reporting by companies on climate and other environmental, social and governance (ESG) matters.

On 3 November 2021, the IFRS Foundation Trustees announced the creation of a new standard-setting board—the International Sustainability Standards Board (ISSB).

The ISSB will benefit from the consolidation of global bodies (Climate Disclosure Standards Board – CDSB, International Integrated Reporting Council – IIRC and Sustainability Accounting Standards Board – SASB) – as well as the support of International Organization of Securities Commission – IOSCO, Task Force on Climate-related Financial Disclosures – TCFD and World Economic Forum – WEF). Together they share the aim of enterprise value-focused sustainability disclosures.

The World Economic Forum has also released a set of universal ESG metrics and disclosures that companies can report on. These metrics and disclosures are aligned with the UN SDGs: Principles of governance, planet, people and prosperity.

Compatibility of BRSR with other reporting frameworks

BRSR and Other Standards

Companies preparing and disclosing sustainability reports based on internationally accepted reporting frameworks such as GRI, SASB, TCFD, are allowed to cross refer the disclosures made under such framework to the disclosures sought under BRSR.

Companies may leverage existing disclosures to avoid repetitions.

Mandatory reporting under BRSR shall not restrict companies from making extensive disclosures in their annual reports voluntarily through integrated reporting or other sustainability report frameworks.

What processes does the organisation follow to identify, evaluate, and mitigate ESG risks in its value chain as part of its BRSR compliance?

The BRSR framework focus on sustainability and responsible business practices of the value chain members (both upstream and downstream).

It addresses:

Risk Identification

Understanding potential environmental and social risks.

Assessment Processes – BRSR Value Chain Assessment

Evaluating the impact of these risks on operations, stakeholders, and the environment.

Mitigation and Action – BRSR Value Chain Engagement

Highlighting measures to address and manage these risks effectively, ensuring responsible value chain management.

It encourages organisations to transparently disclose their value chain members’ ESG practices, enhancing accountability and aligning with stakeholder expectations.

Let's discuss

Be a Consultivo Academy Certified Professional

QUALIFICATION, AWARENESS & COMPETENCE BUILDING

Online and Onsite Courses: Use our Training and Capacity Building expertise in Sustainability, CSR, Social Responsibility, and Social Governance.

- Featured training courses

Your challenge

Financial markets need to assess the risks and opportunities facing individual companies which arise from environmental, social and governance (ESG) issues, as these affect enterprise value, brand reputation and financials of an enterprise.

As an Independent Sustainability and ESG Consulting Firm, Consultivo offers complete Communication and Disclosure solutions for Corporate Reporting that includes GRI Based Sustainability Reporting, ESG Reporting, CSR Reporting, Carbon Footprint Reporting, Sustainability Communication Reports and other Custom Built Reports.

About Consultivo

Consultivo is one of the leading ESG Consultants in India

An Advisory, Research, Audit & Training organisation helping global businesses in the areas of Sustainability, Business Excellence & Risk Management both at the strategic and operational levels.

Major service verticals include Safety, Sustainability, Environment & Energy, CSR, Management Systems, Organisational Development and Human Capital Development. Consultivo works with 100+ National and International Sustainability related codes, standards and guidelines.

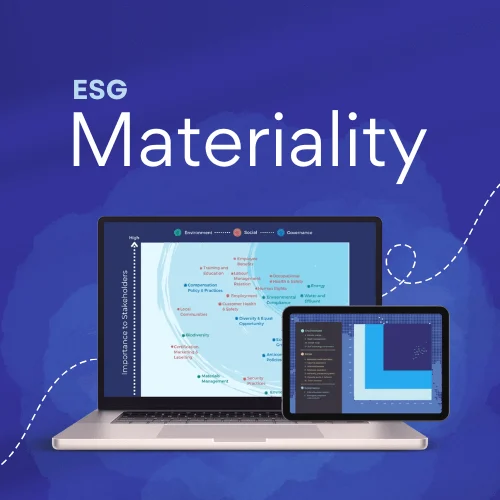

Apart from Independent External Assurance, as a leading ESG Consultant based in India, Consultivo offers ESG Materiality Assessment and Strategy Consulting, ESG Implementation Handholding, Stakeholder Mapping and Engagement, ESG, Sustainability and BRSR Report Preparation and ESG Report Design.

Consultivo Academy offers training and capacity building services both in conventional and new age e-learning platforms.

Browse our Featured Blog

Read a few of our stories as we partner organisations as an ESG, Sustainability and People Advisory Consulting Firm.

Browse our Impact Stories

Read a few of our stories as we partner organisations as an ESG and Sustainability Due Diligence Audit Firm.

Powered by ESG Slate — Consultivo’s AI-driven audit engine.

Speak to us or drop us a WhatsApp message

Featured solutions

Four verticals (Practices)