M&A Due Diligence Services

Trusted for Non-Financial M&A Due Diligence Services: ESG Risks and Opportunities

M&A Due Diligence Services: ESG Due Diligence Audit or E&S Due Diligence, Environmental Due Diligence Audit or EDD, EHS Due Diligence, OHS Due Diligence, HR Due Diligence or HRDD and BHRDD – Business & Human Rights Due Diligence Services in India

Home / Audit and Assurance / M&A Due Diligence Services

As one of the leading non-financial due diligence service companies in India, Consultivo supports investors, and investees, financial consultants in the M&A process.

Our due-diligence audit reports uncover risks, improve valuations, and build confidence in every transaction.

Our M&A Due Diligence Services

ESG Due Diligence

Environmental Due Diligence

E&S Due Diligence

EHS Due Diligence

OHS Due Diligence

HR Due Diligence

B&HR Due Diligence

GLOBAL Experience

Transforming businesses for a sustainable tomorrow

750+ clients

in over 4 continents and 19 countries

2K+ projects

across the value chain

15+ years

at the forefront of ESG and Sustainability Advisory Space

Ensure every deal is built on a foundation of thorough, strategic due diligence. Our expertise helps protect investments, enhance transaction value, and promote seamless post-acquisition integration.

Ready to Unlock Non-Financial Due Diligence Excellence?

Reach out to us today to discuss your upcoming M&A projects and discover how Consultivo can support you with comprehensive due diligence.

Related services for Informed Decision-Making

Identify ESG risks and opportunities and develop a tailored action plan with our ESG Gap Assessment.

For a gap assessment in overall environmental management, governance, compliance & performances.

Identifying gaps related to environmental regulations and industry-specific compliance.

Assess occupational health and safety risks.

Identify the EHS (Environment, Health & Safety) risks in your unit/operations that may lead to a loss.

Optimise your HR practices and enhance employee satisfaction with our expert HR audits.

Includes workforce-related risks, compliance with labour laws and human rights issues.

Assess the potential environmental & social impacts of a project to identify mitigation measures.

Why Choose Consultivo as one of the M&A Due Diligence companies in India?

Industry Expertise

Decades of experience across multiple sectors including manufacturing, mining, construction, agribusiness, supply chain and services.

Tailored M&A Due Diligence Support

We tailor our due diligence services to meet your specific deal needs - whether on the buy-side or sell-side - to ensure precise risk assessment and smooth integration.

Independent Assessment

Objective insights for unbiased, reliable third party evaluations in every transaction.

Actionable Insights through M&A due-diligence reports

Our reports go beyond identifying risks - we deliver clear, actionable steps to resolve potential issues and ensure deal success.

What Sets Us Apart?

01

Seamless Integration

Our team works alongside legal and financial advisors to ensure an integrated approach to M&A transactions.

02

Global Expertise, Local Focus

We bring international best practices with region-specific knowledge, ensuring compliance with both global and local standards.

03

Post-Acquisition Support

We don't stop with the report - our team offers post-acquisition support to manage identified risks and ensure operational success.

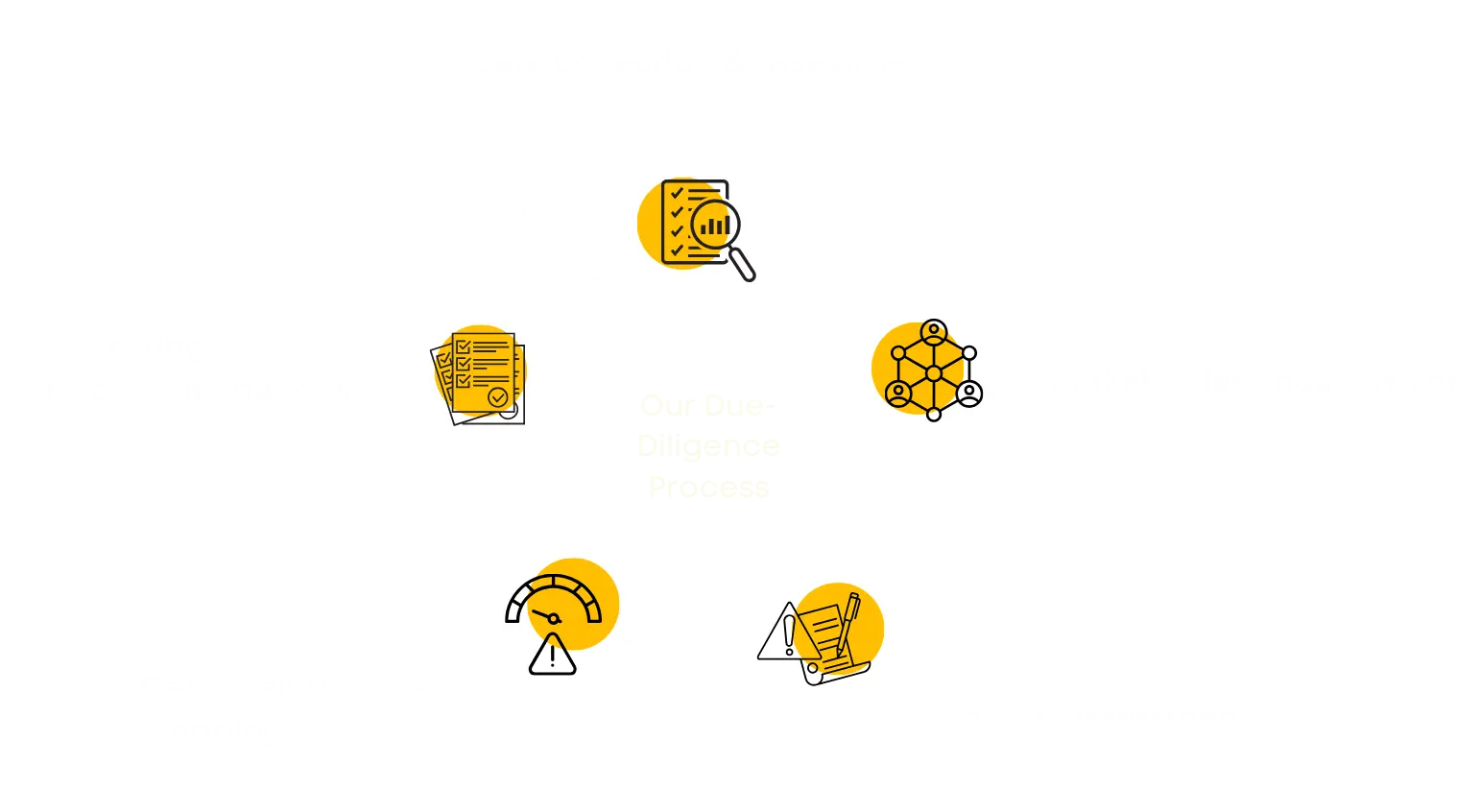

How Consultivo Conducts Due-Diligence

Our Due-Diligence Process

Data Collection & Assessment

Gathering relevant data on your operations, supply chain, and value chain for detailed analysis.

Stakeholder Engagement

Engaging with internal and external stakeholders to understand potential risks and opportunities.

On-Site Assessment

Conducting physical site visits to evaluate real-time conditions and identify non-compliance issues.

Gap Analysis & Risk Mapping

Identifying gaps in current practices and mapping potential risks across environmental, social, and governance aspects.

Reporting & Recommendations

Providing a detailed report with actionable recommendations for mitigating identified risks.

Practical Tips for Interested Parties

- Early ESG Assessment: Start M&A due diligence early in the Investment process to prevent costly surprises later

- Identify Key Stakeholders: Engage all relevant parties, from operations to compliance, early on to ensure a holistic risk review.

- Long-Term Risk Evaluation: Consider long-term regulatory and sustainability risks that could impact deal success.

Unsure where to begin with Non-financial due diligence of your investment decisions?

Our detailed Due diligence (DD) reports help you identify the most important environmental, social, and governance issues for your business and stakeholders.

Focus your efforts, maximise benefits.

Let’s develop a winning due diligence strategy together.

About Consultivo Due Diligence Consulting Services

Consultivo specialises in ESG and Sustainability-focused due diligence, designed to support pre-investment for Greenfield and Brownfield projects and M&A decisions.

With expertise in key areas such as ESG Due Diligence, EHS Due Diligence, OHS Due Diligence, Environmental Due Diligence, HR Due Diligence, and Business & Human Rights Diligence.

As an ESG Due Diligence Consulting company or due diligence audit service provider, we help investors and companies identify risks and liabilities, assess compliance, and unlock opportunities for sustainable growth. We support informed, responsible, and strategic decision-making.

Empanelled sustainability consultant for International Finance Corporation (IFC), World Bank Group, KfW IPEX Bank, Germany and many more financial Institutions.

Consultivo is one of the leading ESG, Business Excellence and Risk Management Consultants.

An Advisory, Research, Audit & Training organisation helping global businesses in the areas of Sustainability, Business Excellence & Risk Management both at the strategic and operational levels.

Major service verticals include Safety, Sustainability, Environment & Energy, CSR, Management Systems, Organisational Development and Human Capital Development.

Consultivo works with 150+ National and International Sustainability related codes, standards and guidelines.

Consultivo Academy provides training and capacity-building services through both in-person sessions and e-learning platforms.

Slate of Swan is purpose driven ESG focused reporting, design, and impact communication agency.

Browse our Impact Stories

Read a few of our stories as we partner organisations as an ESG and Sustainability Due Diligence Audit Firm.

Featured Insights

The CII-Consultivo ESG Readiness Report Launched at CII West Bengal Annual Meeting & Conference 2026

Let's discuss

Curiosity Zone

Questions? We have answers.

What Is Due Diligence?

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

What are Consultivo's core competencies in conducting investment-grade due diligence?

As one of the leading ESG Due Diligence companies in India, Consultivo’s core competencies in investment-grade due diligence span ESG, Environmental, OHS, EHS, E&S, HR, and Business & Human Rights (B&HR) due diligence.

Trusted by organisations like IFC (World Bank Group) and multiple global investors and financial consultants, we also offer environmental, compliance, and HR audits.

Our expertise ensures thorough risk evaluation, regulatory compliance in geographic areas or jurisdictions, and investor confidence, helping drive successful transactions.

Who are the interested parties for a due diligence process?

The interested parties for the due diligence services, particularly for investment and M&A decisions, would include:

- Private Equity Firms & Venture Capitalists: Investors focused on acquiring companies or stakes in businesses who need ESG insights to mitigate risks and align with responsible investment standards.

- Investment Banks & Financial Advisors: Advisors involved in M&A transactions who require comprehensive ESG or Environmental due diligence to offer strategic advice and help structure deals with minimised risks.

- Institutional Investors & Asset Managers: Pension funds, mutual funds, and other institutional investors looking for long-term value through responsible investing practices that factor in ESG risks.

- Corporate M&A Teams: Internal teams in companies planning acquisitions, joint ventures, or mergers, especially those committed to ESG-driven growth and sustainability objectives.

- Legal & Risk Advisors: Law firms and risk management consultants advising clients on the legal and compliance risks associated with ESG factors during M&A or investment processes.

- Sovereign Wealth Funds: State-owned investment funds that integrate ESG factors into their decision-making, ensuring their investments align with government policies on sustainability.

- Family Offices & High-Net-Worth Investors: Wealth management entities focused on responsible investments, ensuring ESG alignment for future growth and impact.

- Multinational Corporations (MNCs): Companies expanding through mergers or acquisitions that need to ensure ESG compliance across diverse markets and geographies.

- ESG Ratings Agencies & Analysts: Organisations evaluating the ESG performance of potential investment targets and needing robust data from thorough due diligence processes.

This audience values robust, data-driven ESG analysis to ensure long-term value creation, risk mitigation, and compliance with sustainability frameworks in their investment decisions.

What is Due Diligence Audit?

A due diligence audit is a comprehensive and systematic review conducted to assess various aspects of an organisation, typically before a significant transaction such as a merger, acquisition, or investment. The purpose is to verify the accuracy of the company’s financial records, business operations, legal standing, and overall risks.

Due-diligence audits help stakeholders identify potential issues or liabilities that may affect the transaction or investment decision. The process can cover multiple areas, including:

Financial Due Diligence: Analyses financial statements, cash flows, assets, liabilities, revenue trends, and profitability to ensure that financial data is accurate and reliable.

Legal Due Diligence: Examines legal documents such as contracts, licenses, intellectual property rights, ongoing litigations, and regulatory compliance to identify legal risks.

Operational Due Diligence: Reviews the company’s operations, management practices, supply chains, production processes, and workforce to assess the efficiency and sustainability of its operations.

Tax Due Diligence: Ensures that the company is in compliance with tax regulations and has no outstanding tax liabilities.

Environmental, Social, and Governance (ESG) Due Diligence: Evaluates the company’s sustainability practices, ethical standards, environmental impact, and governance structure.

The goal is to provide a clear picture of the company’s value and potential risks, enabling informed decision-making before proceeding with the transaction.